SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 13, 2019

J.Crew Group, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 333-175075

|

Delaware |

|

22-2894486 |

|

(State or other jurisdiction |

|

(IRS Employer |

225 Liberty Street

New York, New York 10281

(Address of principal executive offices, including zip code)

(212) 209-2500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On July 24, 2019, J.Crew Group, Inc. (the “Company”) and Chinos Intermediate Holdings A, Inc. (“Chinos Intermediate”), an indirect parent holding company of the Company, entered into confidentiality agreements (the “Confidentiality Agreements”) with certain holders of loans and securities (the “Ad Hoc Group”) including (i) loans under the Company’s Amended and Restated Credit Agreement, dated as of March 5, 2015, as amended, supplemented, or otherwise modified from time to time (ii) two series of 13% Senior Secured Notes due 2021 (the “Notes”) issued by J.Crew Brand, LLC and J.Crew Brand Corp. and (iii) Series A Preferred Stock of Chinos Holdings, Inc. (“Chinos Holdings”), the direct parent holding company of Chinos Intermediate, regarding potential transactions to enhance the capital structure of the Company, Chinos Holdings and their affiliates (collectively referred to herein as “J.Crew”). In connection with the potential transactions and pursuant to the Confidentiality Agreements, (i) the Company made a proposal to the Ad Hoc Group, information from which is attached as Exhibit 99.1 (the “Company’s Proposal”), (ii) the Company’s management made a presentation to the Ad Hoc Group, information from which is attached as Exhibit 99.2 (the “Company Presentation”), and (iii) the Ad Hoc Group made a proposal to the Company, information from which is attached as Exhibit 99.3 (the “Ad Hoc Group’s Proposal,” and together with the Company’s Proposal and the Company Presentation, the “Confidential Information”). The Confidentiality Agreements have expired and no agreement has been reached among the parties. There are no further discussions scheduled with the Ad Hoc Group at this time. The Company continues to pursue its previously announced strategic alternatives to strengthen its balance sheet.

The Confidential Information was prepared by the Company solely to facilitate a discussion regarding potential transactions between J.Crew and the Ad Hoc Group and outlines the illustrative terms of potential transactions. The Confidential Information was not prepared with a view toward public disclosure and should not be relied upon to make an investment decision with respect to J.Crew. The inclusion of the Confidential Information should not be regarded as an indication that J.Crew or any third party consider the Confidential Information to be a reliable prediction of future events, and the Confidential Information should not be relied upon as such. The Confidential Information includes certain potential values for illustrative purposes only and such values are not the result of, and do not represent, actual valuations, estimates, forecasts or projections of J.Crew or any third party and should not be relied upon as such. Neither J.Crew nor any third party has made or makes any representation to any person regarding the accuracy of any Confidential Information or the ultimate outcome of any potential restructuring transaction, and none of them undertakes any obligation to publicly update the Confidential Information to reflect circumstances existing after the date when the Confidential Information was prepared or conveyed or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying the Confidential Information are shown to be in error. In the event any transaction occurs in the future, the terms of any such transaction may be materially different than the terms set forth in the Confidential Information. However, no assurance can be given that any such transaction will occur at all.

The information in this report under Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

|

|

99.2 |

|

|

|

99.3 |

|

2

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

J.CREW GROUP, INC. |

||

|

|

|

|

|

|

|

Date: September 13, 2019 |

|

By: |

|

/s/ VINCENT ZANNA |

|

|

|

|

|

Vincent Zanna |

|

|

|

|

|

Chief Financial Officer and Treasurer |

3

Project Monet Company Proposal Overview CONFIDENTIAL W:\Restructuring\Co-Active\J.Crew\Presentations\2019.09.14 - Proposal Blowout\Revised Company Proposal Materials_vBlowout.pptx Time Stamp : 9 March 2017 10:42:26 Exhibit 99.1

By accepting this presentation, recipients acknowledge that they have read, understood and accepted the terms of this Disclaimer. This presentation is subject to the confidentiality provision set forth in the recipients’ applicable Non-Disclosure Agreement. This presentation is the property of, and contains the proprietary and confidential information of J. Crew Group, Inc. and its subsidiaries (collectively, the "Company"), as well as proprietary and confidential information regarding the Company’s business related to its Madewell brand (“Madewell”) and the businesses of the Company other than Madewell (“J. Crew”), each on a standalone basis. This presentation is being provided for informational purposes only and is intended solely to facilitate a discussion regarding a potential restructuring of the Company’s indebtedness. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. No information included in this presentation constitutes, nor can it be relied upon as, legal, tax, investment or other advice. Recipients should consult their independent advisors. This presentation includes summaries of existing instruments, agreements and other documentation. These summaries do not constitute, and cannot be relied upon for, legal, tax, investment or other advice and the Company accepts no responsibility or liability whatsoever for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. Recipients should read the terms of the instruments, agreements or other documentation underlying such summaries in their entirety. Accordingly, this presentation should not be relied upon for the purpose of evaluating the performance of the Company or for any other purpose, and neither the Company nor any of its affiliates, directors, officers, partners, employees, agents or advisers nor any other person, shall be liable for any direct, indirect or consequential liability, loss or damages suffered by any person as a result of this presentation or their reliance on any statement, estimate, target, projection or forward-looking information in or omission from this presentation and any such liability is expressly disclaimed. In all cases, interested parties should conduct their own investigation and analysis of the Company and the information contained herein. This presentation should not be considered as a recommendation by the Company or any affiliate or other person in relation to the Company or any of its subsidiaries, nor does it constitute an offer to sell or a solicitation for an offer to buy the securities, assets or business of the Company, J. Crew or Madewell nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction or pursuant to an exemption therefrom. This presentation shall not form the basis of any contract. Any references to any future or proposed transaction are for illustrative purposes only and the terms of any such transaction should it occur may be materially different than the terms in this presentation. This presentation contains forward-looking statements that are subject to risks, uncertainties and other factors. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward-looking statements. Forward-looking statements give the Company’s current expectations and projections relating to the Company’s, J. Crew’s and/or Madewell’s financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “seek,” “plan,” “intend,” “believe,” “contemplate,” “assume,” “will,” “may,” “could,” “would,” “continue,” “likely,” “should,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events but not all forward-looking statements contain these identifying words. Risks, uncertainties and other factors may cause future results to differ materially from these forward-looking statements, and potentially adversely from the historical results contained herein. You are cautioned not to place undue reliance on the utility of the information in this presentation as a predictor of future performance of the Company or Madewell, as projected financial and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond the Company’s control. All information herein speaks only as of (1) the date hereof, in the case of information about the Company, J. Crew or Madewell, (2) the date of such information, in the case of information from persons other than the Company. The Company does not undertake any duty to update or revise the information contained herein, publicly or otherwise. The Company has not independently verified any third party information and makes no representation as to the accuracy or completeness of any such information. The historical financial information in this presentation includes information that is not presented in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Non-GAAP financial measures may be considered in addition to GAAP financial information, but should not be used as substitutes for the corresponding GAAP measures. Non-GAAP measures in this presentation may be calculated in ways that are not comparable to similarly titled measures reported by other companies. THIS PRESENTATION MAY CONTAIN MATERIAL, NON-PUBLIC INFORMATION WITHIN THE MEANING OF THE UNITED STATES FEDERAL SECURITIES LAWS WITH RESPECT TO THE COMPANY AND ITS SUBSIDIARIES AND THEIR RESPECTIVE SECURITIES. All amounts in this presentation are in USD unless otherwise stated. Disclaimer CONFIDENTIAL Company proposal overview

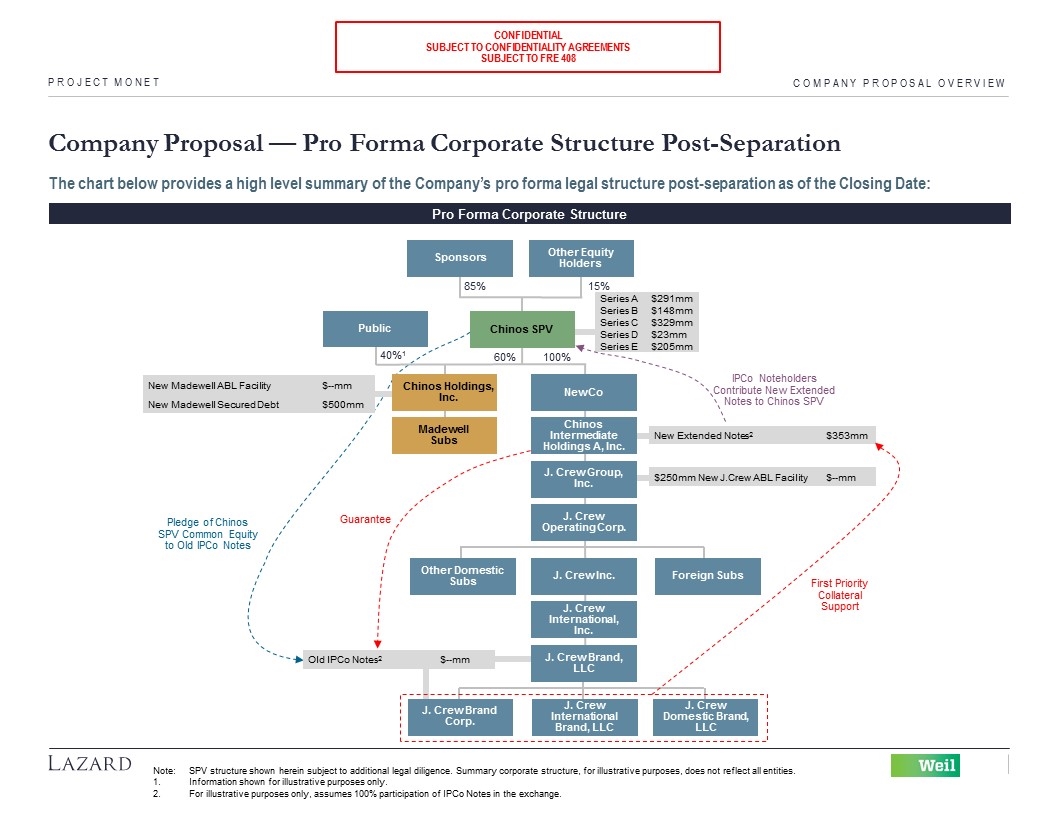

Company Proposal — Transaction Overview Project Monet The materials contained herein outline the Company’s proposal to the Ad Hoc Group with respect to the recapitalization of the Company’s balance sheet in conjunction with a separation of J.Crew and Madewell and concurrent proposed IPO of a portion of Madewell’s equity (the “Company Proposal”) The Company Proposal is premised upon the simultaneous execution of i) the separation of J.Crew and Madewell, ii) a proposed IPO of a portion of Madewell’s equity, iii) a proposed issuance of new debt at Madewell, iv) the creation of a special purpose vehicle (the “Chinos SPV”) that holds J.Crew equity and Madewell equity not sold in the proposed IPO, and v) the recapitalization of the Company’s balance sheet (collectively, the “Transactions”) To facilitate the Transactions, the Ad Hoc Group would execute a transaction support agreement (the “TSA”) with the Company, whereby the Ad Hoc Group agrees to provide the required consents and tender its holdings (as appropriate) Company Proposal Overview Legal Separation Legal separation of J.Crew and Madewell effectuated via a taxable spinoff of the J.Crew business J.Crew and Madewell execute transition service agreements wherein J.Crew agrees to provide certain business functions and services at cost to Madewell to facilitate ongoing operations post-separation Madewell IPO and New Debt Issuance1 IPO of Madewell in which 40% of its equity is sold in the public markets Issuance of $500 million of secured debt (the “New Madewell Secured Debt”) Chinos SPV Chinos SPV to hold i) J.Crew equity contributed by existing shareholders, ii) Madewell equity that is not sold in the IPO, and iii) New Extended Notes (as defined below) Existing shareholders to own 100% of Chinos SPV common equity Recapitalization of Existing Obligations The ABL will be repaid in cash in full Consenting Term Loan Lenders will exchange a portion of their holdings into a senior tranche of new preferred equity securities issued by the Chinos SPV and receive cash for the remainder of their claim2 The IPCo Notes, Series A and B Preferred Stock will be converted into tranches of new preferred equity securities issued by the Chinos SPV and governed by a liquidation preference waterfall that aligns with the current priority waterfall with respect to both J.Crew and Madewell value The IPCo Notes will be exchanged for notes with longer maturities (the “New Extended Notes”), which would then be contributed to the Chinos SPV by the IPCo Noteholders in exchange for preferred securities issued by the Chinos SPV Summary Transaction Structure 1.Information shown for illustrative purposes only. 2.Term Loan exchange mechanics under review by counsel.

40%1 Old IPCo Notes2 $--mm Company Proposal — Pro Forma Corporate Structure Post-Separation Project Monet The chart below provides a high level summary of the Company’s pro forma legal structure post-separation as of the Closing Date: Pro Forma Corporate Structure Madewell Subs NewCo J. Crew Operating Corp. Chinos Intermediate Holdings A, Inc. J. Crew Group, Inc. J. Crew Inc. Public Foreign Subs Other Domestic Subs J. Crew International, Inc. J. Crew Brand, LLC J. Crew Domestic Brand, LLC J. Crew Brand Corp. J. Crew International Brand, LLC Company Proposal Overview New Madewell ABL Facility $--mm New Madewell Secured Debt $500mm $250mm New J.Crew ABL Facility $--mm Note:SPV structure shown herein subject to additional legal diligence. Summary corporate structure, for illustrative purposes, does not reflect all entities. 1.Information shown for illustrative purposes only. 2.For illustrative purposes only, assumes 100% participation of IPCo Notes in the exchange. Guarantee Chinos SPV Chinos Holdings, Inc. 60% Other Equity Holders Sponsors 85% 15% New Extended Notes2 $353mm First Priority Collateral Support Series A $291mm Series B $148mm Series C $329mm Series D $23mm Series E $205mm 100% Pledge of Chinos SPV Common Equity to Old IPCo Notes IPCo Noteholders Contribute New Extended Notes to Chinos SPV

Company Proposal — Overview of Chinos SPV Project Monet Company Proposal Overview As of immediately prior to the consummation of the transactions contemplated by this proposal (and, for the avoidance of doubt, includes accrued and unpaid interest). Includes $276 million on account of Term Loans exchanged into New Chinos SPV Series A, and a $15 million participation fee payable in New Chinos SPV Series A. The Chinos SPV would be capitalized with five tranches of new preferred equity securities that have liquidation preferences according to the current priority waterfall with respect to both J.Crew and Madewell value The Chinos SPV preferred securities would be repaid in cash with the net proceeds from any monetization of i) Madewell equity or J.Crew equity or ii) the repayment of the New Extended Notes, according to the liquidation preference waterfall The dividend rates for the New Series A and New Series B would be determined based on the Madewell TEV at IPO pricing, and calculated according to the Madewell TEV Grid outlined below: Chinos SPV Capitalization – Terms Dividend Rate (PIK) Liquidation Preference Preferred Stock Year 1 Year 2 Year 3 Year 4 Year 5 Onwards Initial Issue Amount1 Holders Maturity Date Madewell Equity J.Crew Equity & New Extended Notes New Series A Madewell TEV ≥ $2,825mm L+322bps L+500bps L+650bps L+800bps NA $291mm2 Term Loan 10/29/23 First Third < $2,825mm ≥ $2,525mm Rates increase 10 bps per $25mm reduction in the Madewell TEV NA < $2,525mm Rates increase 14 bps per $25mm reduction in the Madewell TEV NA New Series B Madewell TEV ≥ $2,825mm 13.00% 13.00% 14.00% 14.00% 14.00% $148mm Amount of IPCo Intercompany Note IPCo Notes 10/29/24 Second First < $2,825mm ≥ $2,525mm Rates increase 10 bps per $25mm reduction in the Madewell TEV < $2,525mm Rates increase 14 bps per $25mm reduction in the Madewell TEV New Series C 7.00% 7.00% 7.00% 10.00% 12.00% $329mm Amount of Series A and B Preferred Stock Preferred Equity Perp. Third Fourth New Series D 7.00% 7.00% 7.00% 10.00% 12.00% $23mm Intercompany Preferred Stock in excess of Series A and B Preferred Stock Common Equity Perp. Fourth Fifth New Series E 13.00% 13.00% 14.00% 14.00% 14.00% 205mm Amount of IPCo Notes in excess of IPCo Intercompany Loan IPCo Notes 10/29/24 Fifth Second Series B Series E Series A 2 Series C Series D Liquidation preference 3 4 5 1 60% 100% Existing Common Equityholders Chinos SPV Madewell J.Crew Series A Series B Series C Series D Series E New Extended Notes 100% Series E Series B 2 Series A Series C 3 4 1 Series D 5 Simplified Chinos SPV Org Structure

Project Monet Company Proposal Overview Company Proposal — Comparison vs. Ad Hoc Group Proposal Calculated as: (Madewell Debt + Applicable Chinos SPV Debt / (1 - % Madewell IPO Float)) / Madewell Enterprise Value. Coupon and warrants determined based on Chinos SPV LTV through the New Series A and New Series C, as appropriate. Coupons compound semiannually. Form of equity consideration subject to further tax and legal diligence. Represents retained Madewell Common Equity held in the Chinos SPV. New Series A and New Series B rates do not include any adjustments on account of potential reductions in the Madewell TEV below $2,825 million. Includes $276 million on account of Term Loans exchanged into New Chinos SPV Series A Preferred Stock and a $15 million participation fee payable in New Chinos SPV Series A Preferred Stock. Includes par plus accrued and make-whole premium of ~$69 million. The table set forth below provides a comparison of the key economic terms and priority ranking of the Chinos SPV securities contemplated in the Company Proposal versus the Ad Hoc Group Proposal Under the Company Proposal, the effective PIK dividend rate of the Chinos SPV securities is based on amount of time since the Closing Date (and for New Series A and New Series B, the Madewell TEV at IPO), versus “Madewell LTV”1 at issuance under the Ad Hoc Group Proposal The PIK dividend rates for the New Series A and New Series B shown below assume a Madewell TEV at IPO of greater than or equal to $2,825 million (and therefore reflect the first tier of the Madewell TEV Grid) Importantly, the Company Proposal does not contemplate i) modifications to the existing waterfall or ii) the issuance of warrants to Chinos SPV securities, as reflected in the Ad Hoc Group Proposal Lien Priority Liquidation Preference Initial Issuance Coupon (PIK)2 Warrants2 Maturity Madewell Equity3 J.Crew Value Initial Issuance PIK Dividend (Grid Tier 1)4 Warrants Maturity Madewell Equity3 J.Crew Value New Series A $276mm 9.00% to 12.00% 10.0% to 17.5% 10/29/22 First Second $291mm5 L+322bps to L+800bps None 10/29/23 First Third New Series B $422mm6 13.00% to 16.00% 10.0% to 17.5% ~3 years After New Series A Second First $148mm 13.00% to 14.00% None 10/29/24 Second First New Series C $200mm 13.00% to 16.00% None ~3 years After New Series B Third Third $329mm 7.00% to 10.00% None Perpetual Third Fourth New Series D $152mm 13.00% to 16.00% None ~3 years After New Series C Fourth Fourth $23mm 7.00% to 10.00% None Perpetual Fourth Fifth New Series E NA NA NA NA NA NA $205mm 13.00% to 14.00% None 10/29/24 Fifth Second Chinos SPV Capitalization — Key Terms Company Proposal Ad Hoc Group Proposal (7/31/19)

Project Monet Company Proposal Overview Revised Company Proposal — New Series A and B Dividend Rates ($ in millions) The chart below illustrates the PIK dividend rates on the New Series A and New Series B according to the Madewell TEV Grid in year one based on a range of Madewell valuations The dividend rates below are based on the Madewell TEV Grid and threshold values In a scenario in which the IPO is priced based on a Madewell TEV between $2,525 million and $2,825 million, the initial dividend rates begin to increase at a rate of 10 basis points per $25 million decrease in the Madewell TEV In a scenario in which the IPO is priced based on a Madewell TEV of less than $2,525 million, the dividend rates begin to increase at a more accelerated rate of change (14 basis points per $25 million decrease in the Madewell TEV below $2,525 million) New Series A Initial PIK Dividend Rate New Series B Initial PIK Dividend Rate 10 basis point increase per $25 million decrease 14 basis point increase per $25 million decrease 10 basis point increase per $25 million decrease 14 basis point increase per $25 million decrease Madewell TEV Madewell TEV $2,925 $2,925

Est. Amt. Outstanding (10/29/19)1 Proposed Treatment ABL [Redacted]2 Paid in full in cash at par plus accrued interest at the non-default rate Term Loans $1,372mm Consenting Term Loan Lenders exchange a portion of their Term Loans into New Chinos SPV Series A Preferred Stock and receive the balance of their claim (par plus accrued interest at the non default rate) in cash3 The amount of cash paydown will equal the Madewell IPO and Madewell Secured Debt proceeds less i) the outstanding ABL balance (including applicable fees and accrued and unpaid interest), ii) all fees and expenses (including fees and expenses of professionals) incurred in connection with the Transactions, iii) if necessary, a cash tax reserve, iv) if necessary, a reserve to prefund any Old IPCo Notes principal and interest, and v) if necessary, the par amount plus applicable accrued interest at the non-default rate of non-consenting Term Loan Lenders The amount of Term Loans being exchanged into New Chinos SPV Series A Preferred Stock will equal the remaining Term Loan claim (par plus accrued interest at the non-default rate) after giving effect to the cash paydown Consenting Term Loan Lenders would also receive their pro rata share of a $15 million participation fee, which is payable in New Chinos SPV Series A Preferred Stock on the Closing Date Non-Consenting Term Loan Lenders will be paid in full in cash at par plus accrued interest at the non-default rate IPCo Notes $353mm Exchanged into New Extended Notes at par plus accrued interest at the non-default rate with the following terms4: Issuer: Chinos Intermediate Holdings A, Inc. (“Chinos A”) Guarantors: J.Crew International Brand, LLC; J.Crew Brand Corp.; J.Crew Brand Intermediate, LLC and J.Crew Domestic Brand, LLC (each of the foregoing, the “IPCo Guarantors”) Maturity: Extended by 3.25 years to December 2024 Interest: 13.00%, paid-in-kind through September 15, 2021; thereafter, 6.00%, paid-in-kind Collateral: A first lien on all assets of the IPCo Guarantors, subject to customary exceptions and exclusions Call Protection: Callable at 105% until September 2021 (Old IPCo Notes’ maturity) and at 100% thereafter Exit Consents: Agree to amendments of Old IPCo Notes indenture that would i) authorize forbearance from payments (other than those payments necessary to service the Old IPCo Notes) under IP license agreements through extended maturity, ii) release existing collateral, including the 8.50% Senior PIK Toggle Notes due 2020, iii) consent to waiver of a right to accelerate Old IPCo Notes, and iv) remove all covenants permitted to be amended Minimum Tender Threshold: 95%, which can be lowered by the Company in its sole discretion Extending IPCo Noteholders to contribute New Extended Notes to Chinos SPV in exchange for $148 million of New Chinos SPV Series B Preferred Stock and $205 million of New Chinos SPV Series E Preferred Stock At the Company’s option, receive cash at 105% of par at closing in lieu of Preferred Stock Offered to the extent that net cash proceeds from the Madewell IPO and New Madewell Secured Debt issuance exceed the Transaction Threshold Amount “Transaction Threshold Amount” is the sum of i) outstanding ABL (including accrued interest), ii) outstanding Term Loans (including accrued interest), iii) all fees and expenses (including fees and expenses of professionals) incurred in connection with the Transactions, iv) if necessary, a tax cash reserve, and v) if necessary, a reserve to prefund any Old IPCo Notes principal and interest Provided pro rata to Extending IPCo Noteholders Project Monet Company Proposal Overview Company Proposal — Term Sheet As of immediately prior to the consummation of the transactions contemplated by this proposal (and, for the avoidance of doubt, includes accrued and unpaid interest). Professional eyes only figure, not subject to blowout. Term Loan exchange mechanics under review by counsel. Any holdouts to receive pledge of Chinos SPV common equity (subject to further legal diligence).

Est. Amt. Outstanding (10/29/19)1 Proposed Treatment Intercompany Indebtedness $148mm Cancellation of intercompany loan due 2021 owed by J.Crew Group, Inc. to J.Crew Brand, LLC On the Closing Date, Chinos A will exchange the New Extended Notes to holders of Old IPCo Notes and contribute the Old IPCo Notes to J. Crew Group, Inc. as a capital contribution. J.Crew Group, Inc. will then deliver the Old IPCo Notes to J.Crew Brand, LLC, and in consideration therefor the intercompany loan due 2021 owed by J.Crew Group, Inc. to J. Crew Brand, LLC will be deemed paid in full (subject to further legal diligence) IP License Agreement NA Amended to provide royalty free use of the Licensed Marks (other than those payments necessary to service the Old IPCo Notes) Series A Preferred Stock $200mm Converted into New Chinos SPV Series C Preferred Stock Holders of at least 66% of the Series A Preferred Shares will cause the certificate of designation of the Series A Preferred Shares to be amended before the Closing Date, resulting in: An automatic, mandatory conversion of the Series A Preferred Shares concurrent with the consummation of the Madewell IPO into the right to receive the Liquidation Value This amendment will redefine “Liquidation Value” to be equal to the outstanding amount plus accrued interest as of the Closing Date, and will permit such value to be payable in New Chinos SPV Series C Preferred Stock at the on the Closing Date Series B Preferred Stock $129mm Converted into New Chinos SPV Series C Preferred Stock Sponsors will cause the certificate of designation of the Series B Preferred Shares to be amended before the Closing Date, resulting in: An automatic, mandatory conversion of the Series B Preferred Shares upon the consummation of the IPO into the right to receive the Liquidation Value This amendment will redefine “Liquidation Value” to be equal to the outstanding amount plus accrued interest as of the Closing Date, and will permit such value to be payable in New Chinos SPV Series C Preferred Stock on the Closing Date Common Equity 100% beneficial ownership of Chinos SPV $23 million of New Chinos SPV Series D Preferred Stock $351 million of Intercompany Preferred Stock issued by Chinos Intermediate, Inc. to Chinos Holdings, Inc.; after conversion of $329 million of aggregate Series A and Series B Preferred Stock, remaining $23 million distributed to common equity Management Incentive Plan Management for standalone J.Crew and Madewell will be entitled to participate in applicable management incentive plans on terms to be determined Company Proposal — Term Sheet (cont’d) Project Monet Company Proposal Overview As of immediately prior to the consummation of the transactions contemplated by this proposal (and, for the avoidance of doubt, includes accrued and unpaid interest).

~$364 million of Madewell cash proceeds utilized to i) pay down the entirety of current ABL borrowings, and ii) pay all transaction related fees and expenses1 Based on Term Loan cash pay down of $1,096 million, the remaining $276 million of Term Loan claims (par plus accrued interest at the non-default rate) will be exchanged into New Chinos SPV Series A Placeholder reserve for tax leakage as a result of the separation of J.Crew and Madewell, subject to further diligence At the IPO valuation, $1,455 million of Madewell equity (60%) is contributed to the Chinos SPV1 Company Proposal — Sources & Uses at Closing ($ in millions) Project Monet Set forth below are the sources and uses and Madewell equity splits under the Company Proposal: Selected Commentary 1 2 Company Proposal Overview Note: Assumes balance sheet cash pre-separation funds post-separation balance sheet cash at J.Crew and Madewell. 1.For illustrative purposes only. Does not reflect an actual transaction or valuation. Illustrative Sources & Uses at Closing 1 3 2 3 4 4

Presentation to Ad Hoc Group Exhibit 99.2 Subject to Confidentiality Agreements To Be Used for The Sole Purpose of Evaluating A Potential Recapitalization of This J.Crew Business

Disclaimer By accepting this presentation, recipients acknowledge that they have read, understood and accepted the terms of this Disclaimer. This presentation is subject to the confidentiality provision set forth in the recipients’ applicable Non‐Disclosure Agreement. This presentation is the property of, and contains the proprietary and confidential information of J. Crew Group, Inc. and its subsidiaries (collectively, the "Company"), as well as proprietary and confidential information regarding the Company’s business related to its Madewell brand (“Madewell”) and the businesses of the Company other than Madewell (“J. Crew”), each on a standalone basis. This presentation is being provided for informational purposes only and is intended solely to facilitate a discussion regarding a potential restructuring of the Company’s indebtedness. No representation or warranty, express or implied, is or will be given by the Company or its affiliates, directors, officers, partners, employees, agents or advisers or any other person as to the accuracy, completeness, reasonableness or fairness of any information contained in this presentation and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. No information included in this presentation constitutes, nor can it be relied upon as, legal, tax, investment or other advice. Recipients should consult their independent advisors. This presentation includes summaries of existing instruments, agreements and other documentation. These summaries do not constitute, and cannot be relied upon for, legal, tax, investment or other advice and the Company accepts no responsibility or liability whatsoever for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. Recipients should read the terms of the instruments, agreements or other documentation underlying such summaries in their entirety. Accordingly, this presentation should not be relied upon for the purpose of evaluating the performance of the Company or for any other purpose, and neither the Company nor any of its affiliates, directors, officers, partners, employees, agents or advisers nor any other person, shall be liable for any direct, indirect or consequential liability, loss or damages suffered by any person as a result of this presentation or their reliance on any statement, estimate, target, projection or forward‐looking information in or omission from this presentation and any such liability is expressly disclaimed. In all cases, interested parties should conduct their own investigation and analysis of the Company and the information contained herein. This presentation should not be considered as a recommendation by the Company or any affiliate or other person in relation to the Company or any of its subsidiaries, nor does it constitute an offer to sell or a solicitation for an offer to buy the securities, assets or business of the Company, J. Crew or Madewell nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction or pursuant to an exemption therefrom. This presentation shall not form the basis of any contract. Any references to any particular transaction are for illustrative purposes only. THIS PRESENTATION MAY CONTAIN MATERIAL, NON‐PUBLIC INFORMATION WITHIN THE MEANING OF THE UNITED STATES FEDERAL SECURITIES LAWS WITH RESPECT TO THE COMPANY AND ITS SUBSIDIARIES AND THEIR RESPECTIVE SECURITIES. All amounts in this presentation are in USD unless otherwise stated. Cautionary Note Regarding Forward‐Looking Information, Forecasts and Projections This presentation contains forward‐looking statements, including forecasts and projections, that are subject to risks, uncertainties and other factors. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward‐looking statements. Forward‐looking statements include projections and forecasts relating to the Company’s, J. Crew’s and/or Madewell’s financial condition, results of operations, plans, objectives, future performance and business. You can identify forward‐looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “seek,” “plan,” “intend,” “believe,” “contemplate,” “assume,” “will,” “may,” “could,” “would,” “continue,” “likely,” “should,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events but not all forward‐ looking statements contain these identifying words. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward‐looking statements contained in this report. Important factors that could cause our actual results to differ include, but are not limited to, our substantial indebtedness, our substantial lease obligations, our ability to anticipate and timely respond to changes in trends and consumer preferences, the strength of the global economy, competitive market conditions, our ability to attract and retain key personnel, our ability to successfully develop, launch and grow our newer concepts and execute on strategic initiatives, product offerings, sales channels and businesses, our ability to implement our growth strategy, material disruption to our information systems, compromises to our data security, our ability to maintain the value of our brands and protect our trademarks, our ability to implement our real estate strategy, changes in demographic patterns, adverse or unseasonable weather or other interruptions in our foreign sourcing, customer call, order fulfillment or distribution operations, increases in the demand for or prices of raw materials used to manufacture its products, trade restrictions or disruptions and other factors as set forth in the Company’s annual report on Form 10‐K for the fiscal year ended February 2, 2019. WE DO NOT, AS A MATTER OF COURSE, PUBLICLY DISCLOSE PROJECTIONS AS TO OUR FUTURE REVENUES, EARNINGS OR CASH FLOWS. SOLELY IN CONNECTION WITH OUR CONSIDERATION OF A POTENTIAL TRANSACTION, CERTAIN PROJECTIONS OF OUR FUTURE FINANCIAL PERFORMANCE OF OUR OPERATING BUSINESSES WERE PREPARED AND INCLUDED HEREIN. ACCORDINGLY, WE DO NOT INTEND TO REVIEW, UPDATE OR OTHERWISE REVISE THE PROJECTIONS. THE PROJECTIONS SET FORTH HEREIN WERE NOT PREPARED TO CONFORM WITH PUBLISHED GUIDELINES OF THE SEC, ANY STATE SECURITIES COMMISSION OR THE AMERICAN INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS REGARDING PREPARATION AND PRESENTATION OF PROSPECTIVE FINANCIAL INFORMATION. THE COMPANY’S INDEPENDENT ACCOUNTANTS HAVE NOT COMPILED, EXAMINED OR PERFORMED ANY PROCEDURES WITH RESPECT TO THE PROJECTIONS, NOR HAVE THEY EXPRESSED ANY OPINION OR ANY OTHER FORM OF ASSURANCE WITH RESPECT THERETO OR THEIR ACHIEVABILITY. ALL FORWARD‐LOOKING INFORMATION, INCLUDING THE PROJECTIONS, REFLECT NUMEROUS ASSUMPTIONS AND ESTIMATES, ALL MADE BY MANAGEMENT WITH RESPECT TO INDUSTRY PERFORMANCE, GENERAL BUSINESS, ECONOMIC, MARKET AND FINANCIAL CONDITIONS AND OTHER MATTERS, ALL OF WHICH ARE DIFFICULT TO PREDICT AND SUBJECT TO THE RISKS AND UNCERTAINTIES DESCRIBED ABOVE, AND MANY OF WHICH ARE BEYOND THE COMPANY’S CONTROL. THERE CAN BE NO ASSURANCE THAT THE ASSUMPTIONS AND ESTIMATES MADE IN PREPARING THE FORWARD‐LOOKING INFORMATION AND PROJECTIONS SET FORTH HEREIN WILL PROVE ACCURATE. ALL FORWARD‐LOOKING INFORMATION, BY ITS NATURE, IS INHERENTLY UNCERTAIN. THE FORWARD‐LOOKING INFORMATION CONTAINED HEREIN HAS BEEN PROVIDED FOR INDICATIVE PURPOSES ONLY, IS PRELIMINARY, IS NOT A GUARANTEE OF FINANCIAL PERFORMANCE AND REMAINS SUBJECT TO CHANGE, INCLUDING DUE TO THE VARIOUS SIGNIFICANT RISKS, UNCERTAINTIES ANY OTHER FACTORS DESCRIBED ABOVE. ACCORDINGLY, FOR THESE REASONS, WE CAUTION YOU AGAINST RELYING ON ANY FORWARD‐ LOOKING INFORMATION. All information herein speaks only as of (1) the date hereof, in the case of information about the Company, J. Crew or Madewell, (2) the date of such information, in the case of information from persons other than the Company. The Company does not undertake any duty to update or revise the information contained herein, publicly or otherwise. The historical financial information in this presentation includes information that is not presented in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Non‐GAAP financial measures may be considered in addition to GAAP financial information, but should not be used as substitutes for the corresponding GAAP measures. Non‐GAAP measures in this presentation may be calculated in ways that are not comparable to similarly titled measures reported by other companies.

Key Drivers of Q4’18A Performance The Company’s Q4’18A underperformance was driven by the deployment of certain strategies for the J.Crew business that were ultimately unsuccessful; in response, Management has taken immediate and decisive actions to refocus J.Crew’s strategy and position it for long-term profitability and growth Substantial inventory investment across all categories led to excessive promotional activities and write- down of inventory in Q4’18A Estimated $79 million total impact on Gross Margin in Q4’18A Inventory balance of $390 million at FY’18A, a ~33% increase from $292 million at FY’17A INVENTORY MANAGEMENT BRANDING & MERCHANDISING STRATEGY INCREASED MARKETING & OVERHEAD EXPENSE J.CREW PERFORMANCE DRIVER ACTIONS TAKEN IN RESPONSE The launch of a sub-brand strategy resulted in confusion for customers Testing of an everyday low price strategy with the Factory brand did not produce a strong customer response Accelerated marketing spend and overhead investments were made in connection with the sub- branding strategy Quickly moving its excess and slow- moving product in order to right- size its inventory position Managing inventory with increased discipline is a top priority in FY’19E and is expected to result in significant gross margin improvement Eliminating sub-brands introduced in 2018 including Mercantile, Nevereven, and the Home business Rationalizing assortment to focus on key franchises Factory brand has reverted back to the value-based pricing model in 2019 The decision to eliminate sub- brands and discontinue other branding initiatives will reduce complexity and provide cost-saving opportunities Aggressively managing expenses is a top priority in 2019 Source: J.Crew Group Inc. FY’18 10-K, earnings release, and earnings call transcript.

J.Crew Standalone — Business Plan Strategy & Key Initiatives Standalone J.Crew is focused on pursuing various strategic initiatives to best position the J.Crew brand for long‐term success and growth Reimagine Product & Assortment Strategy Refocus & Clarify our Brand Strategy and Positioning Create new reasons to buy by infusing loved franchises with newness in fabric, fit and design Introduce new franchise items that are on‐trend extensions of our most popular heritage items Reduce underperforming products from our product mix to focus on our core performers Rebalance the fashion pyramid to increase penetration of core and seasonal styles, while decreasing fashion Return of Chris Benz as SVP of Design to provide a fresh design perspective and improved product assortment Listen to our customers to meet their fit and quality preferences Refresh cross‐channel brand expression to focus on product, quality and style Improve customer acquisition and retention through coordinated, proactive marketing campaigns Elimination of sub‐ brands in FY’19B to reduce customer confusion and go‐ to‐market as focused brand Increase customer engagement and brand awareness through digital marketing and increased online presence Use Data to Inform Decisions Shift Footprint to a More Digital Direct Model Continue investment in loyalty program to increase customer engagement, drive customer acquisition, and provide the Company with valuable customer data − Acquisition of customer data provides insight that informs marketing and purchasing strategy − Introduction of personalized content delivery and targeted offers to loyalty members Use customer inputs to support product development and optimize inventory investments Utilize data to understand customer purchasing behavior and enable personalized experiences Ensure holistic approach to evolving and modernizing J.Crew operating model to capitalize on momentum in online sales Streamline product assortment, marketing strategies, and online purchasing process Continue to opportunistically rationalize store footprint to reduce fixed costs and increase profitability Invest in opportunities to increase efficiency in distribution and fulfillment to improve service levels for DTC customers Continue development of the “store of the future” vision to offer customers convenient, service‐focused, and digitally‐integrated in‐ person shopping experiences

$46 $94 $77 $109 $120 $126 5% 6% 6% 7% 7% S A L E S (1) E B I T D A (1) J.Crew Brand Standalone — Management Financial Forecast Note: Standalone projections pro forma for separation, including TSA. These projections are forward‐looking, are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of J. Crew and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results may vary and these variations may be material. Financials presented on an internal management reporting basis where certain items in sales, gross margin and expense are classified differently with no impact to EBITDA as compared to an external financial view. Primary differences internally include customer shipping income excluded from sales, and Buying and Occupancy and handling expense (portion of DC labor) excluded from gross margin. For comparative purposes, J.Crew Brand FY’17A and FY’18A gross margin was 49.9% and 43.3%, respectively. Includes J.Crew and J.Crew Factory. EBITDA includes impact of annual cost savings. $769 $710 $643 $590 $563 $543 $896 $918 $984 $1,054 $1,129 $1,209 $1,816 Total Brand Comp Total Store Count Retail Online Wholesale ($ in millions, unless otherwise noted) J.Crew (including Factory) is projected to generate EBITDA improvements driven primarily by cost savings initiatives and continued growth in the online channel $1,731 $1,681 $1,683 $1,702 $1,753 $65 $53 $56 $58 $61 $64 EBITDA Margins Annual Cost Savings (2) Gross Margin 2019B 2020E 2021E 2022E 2023E 2024E 2019B 2020E 2021E 2022E 2023E 2024E (2.2%) 2.4% 3.5% 3.8% 4.1% 4.4% $10.1 $33.0 $42.8 $54.0 $54.0 $54.0 344 316 302 291 289 285 45.4% 46.2% 46.3% 46.2% 46.2% 46.0% 3%

$602 $526 $469 $646 $701 $690 $694 $745 $798 $855 $916 $1,224 $1,189 $1,202 $1,221 $1,267 $1,325 $386 $347 $301 $268 $241 $225 $212 $198 $207 $593 $560 J . C r e w ( e x c l . F a c t o r y ) S a l e s F a c t o r y S a l e s J.Crew Brand Standalone — J.Crew vs. Factory Sales Forecast Breakdown ($ in millions, unless otherwise noted) Note: Standalone projections pro forma for separation, including TSA. These projections are forward‐looking, are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of J. Crew and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results may vary and these variations may be material. Financials presented on an internal management reporting basis where certain items in sales, gross margin and expense are classified differently with no impact to EBITDA as compared to an external financial view. Primary differences internally include customer shipping income excluded from sales, and Buying and Occupancy and handling expense (portion of DC labor) excluded from gross margin. $65 $53 $56 $58 $61 $64 Total Store Count Gross Margin Retail Online Wholesale Total Store Count Gross Margin Retail Online $507 $491 $481 $482 $486 $491 $213 $206 $223 $239 $256 $274 $294 $1,273 $1,277 $25 $50 FY'17A FY'18A FY'19B FY'20E FY'21E FY'22E FY'23E FY'24E FY'17A FY'18A FY'19B FY'20E FY'21E FY'22E FY'23E FY'24E 235 203 176 162 157 147 146 144 176 174 168 154 145 144 143 141 50.8% 43.5% 46.2% 47.2% 47.3% 47.3% 47.5% 47.3% 48.0% 42.9% 43.6% 43.8% 43.8% 43.3% 42.8% 42.3%

J.Crew Brand Standalone — Cash Flow Projections ($ in millions) J.Crew (including Factory) is projected to generate positive cash flow from FY’19B – FY’24E Note: Standalone projections pro forma for separation, including TSA. These projections are forward‐looking, are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of Madewell and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results may vary and these variations may be material. All presented figures include J.Crew and J.Crew Factory, except where noted otherwise. Before impact of cost savings initiatives, a portion of which would be applicable to items other than Corporate SG&A. J.CREW — STANDALONE CASH FLOW PROJECTIONS (1) Annual FY' 19B FY' 20E FY' 21E FY' 22E FY' 23E FY' 24E J.Crew EBITDA $ 46 $77 $94 $109 $120 $126 % Margin 2.7% 4.6% 5.6% 6.4% 6.9% 6.9% (‐) Change in Working Capital $12 $2 ($6) ($2) ($3) ($1) (‐) Cash Taxes Paid (1) (1) (5) (16) (19) (34) (‐) CapEx (28) (21) (23) (25) (27) (29) (‐) Other Items (5) (7) (3) (5) ‐‐ ‐‐ Unlevered Free Cash Flow $ 24 $50 $57 $60 $71 $61 Memo: Inventory $260 $248 $253 $257 $267 $278 Corporate SG&A (Net of TSA Revenue)(2) 176 180 193 201 208 216

Project Paddle Ad hoc Group proposal 1 Exhibit 99.3

Ad Hoc Group Proposal Term Sheet(1) Terms set forth in the Company’s proposal, but not addressed herein, remain subject to ongoing review and discussion. Form of equity consideration is subject to further tax and legal diligence and therefore may change. 2 Proposed Terms Term Loan Treatment Consenting: (i) Exchange portion of term loans into New Series A, and (ii) Receive the balance of par plus accrued interest claim in cash Non-Consenting: Cash repayment of par plus accrued interest claim Term Loan Backstop Description: Certain parties willing to consider backstopping a cash repayment of non-consenting term loan claims Backstop fee: Form of consideration and amounts TBD New Series A Security: Up to $430mm of Chinos SPV Senior Secured Notes due 2022 (~3 year tenor maturing inside Series B) Collateral: First lien on retained Madewell common equity Second lien on (i) existing IPCo Notes collateral, and (ii) retained J. Crew common equity Coupon: Annual PIK rate from 9.0% - 12.0%, compounding semi-annually, based on Madewell Grid Warrants(1): Detachable penny warrants for 10.0% - 17.5% of Chinos SPV common equity based on Madewell Grid IPCo Notes Treatment Consenting: Exchange into New Series B at par plus make-whole premium Non-Consenting: TBD New Series B Security: Chinos SPV Senior Secured Notes due 2022 (~3 year tenor maturing outside Series A) Collateral: First lien on (i) existing IPCo collateral, and (ii) retained J. Crew common equity Second lien on retained Madewell common equity Coupon: Annual PIK rate from 13.0% - 16.0%, compounding semi-annually, based on Madewell Grid Warrants(1): Detachable penny warrants for 10.0% - 17.5% of Chinos SPV common equity based on Madewell Grid

Proposed Terms Existing Series A Preferred Stock Treatment Converted into New Series C New Series C Security: Chinos SPV Senior Secured Notes due 2022 (~3 year tenor maturing outside Series B) Collateral: Third lien on retained Madewell common equity Third lien on (i) existing IPCo collateral, and (ii) retained J. Crew common equity Coupon: Annual PIK rate from 13.0% - 16.0%, compounding semi-annually, based on Madewell Grid Existing Series B Preferred Stock Treatment(2) Converted into New Series D New Series D Security: Chinos SPV Senior Secured Notes (maturing outside Series C) Collateral: Fourth lien on retained Madewell common equity Fourth lien on (i) existing IPCo collateral, and (ii) retained J. Crew common equity Coupon: Same as New Series C Other Terms Covenants: TBD Governance: TBD Intercreditor: TBD IPO Thresholds Minimum Madewell IPO enterprise valuation: $2,520mm Maximum Madewell loan-to-value through New Series C: 90% Ad Hoc Group Proposal Term Sheet(1) (Cont’d) Terms set forth in the Company’s proposal, but not addressed herein, remain subject to ongoing review and discussion. Treatment also applicable to intercompany preferred stock in excess of existing Series A and B preferred stock. 3

Ad Hoc Group Proposal Madewell Grid Coupon and Warrant levels tied to Madewell LTV(1) calculated at TBD determination date Madewell LTV thresholds defined for Series A and Series B/C, respectively Applicable levels to be interpolated linearly and rounded to the nearest 12.5 bps increment Illustrative calculation: (Madewell debt + applicable Chinos SPV debt / (1- % Madewell IPO Float)) / Madewell enterprise value. 4

5